Navigating Data Analytics: From Raw Data to BI and Decision Making

Dive into the transformative power of data analytics within the insurance sector.

Join us to understand the essence of a powerful data strategy, align your team from the top-down, and foster impactful collaboration. In addition, we will be showcasing real-world applications resulting in process enhancement, improved customer experience and effective policy metrics tracking.

CELENT REPORT

Adacta wins XCelent advanced technology award

For policy administration systems (PAS) in EMEA life Insurers

INDUSTRY RESEARCH REPORT

Adacta recognized as a LEADER in the Insurance Platform Solutions 2023 ISG’s Provider Lens™

Insightful Research to Guide Your Selection of Property and Casualty, as well as Life and Retirement Insurance Platform Solutions Vendor!

free webinar on demand

Transforming Insurance: Low-Code’s Role in Digital Revolution

Insurers have made digital transformation a crucial objective, and many are utilizing low-code technologies to enhance their agility in launching new software solutions. Our upcoming webinar presents an opportunity to learn from seasoned industry experts about low-code advantages in the insurance sector.

Join us and elevate your insurance business to the next level with low-code technology insights.

Gartner® Market Guide

Adacta recognized in the 2022 Gartner® Market Guide

Adacta had been acknowledged as a Representative Vendor in the 2022 Gartner Market Guide for Non-Life Insurance Core Platforms, Europe.

ADACTA SURVEY

State of low-code in insurance

Gain valuable insights into the current state of low-code adoption in the insurance industry, including trends in investments, benefits, and obstacles.

WHITE PAPER

A prespective on modernizing legacy in insurance

The case for transforming insurers’ digital capabilities by replacing legacy core systems with a modern insurance platform.

Managing insurance regulatory compliance in the digital age

As the amount of regulation for insurance companies grows, the compliance risk becomes one of the biggest challenges insurers are facing today.

Join us for the live webinar and learn how insurers can leverage the capabilities of modern technology to proactively meet regulatory requirements and minimize the compliance risk.

Modernise your life and non-life business with a single insurance platform

Meet AdInsure, the digital platform that unites your teams, streamlines your processes and helps you adapt to change.

ANALYST REPORT

Adacta wins XCelent advanced technology award

For policy administration systems (PAS) in EMEA life Insurers

ADINSURE FOR COMMERCIAL INSURANCE

Transform your commercial insurance

AdInsure is a modern platform used by insurers across different commercial lines to digitalize their products, transform processes and business models, launch new offerings faster, and manage change effectively.

Latest news

![]()

Don’t miss the next edition of Adacta Insights, an insurance-focused newsletter. Sign up here

![]()

Join Us at ITC DIA 2023: Europe’s Premier Insurtech Event in Barcelona

![]()

Adacta Releases Market Survey on the State of Low-Code in the Insurance Industry

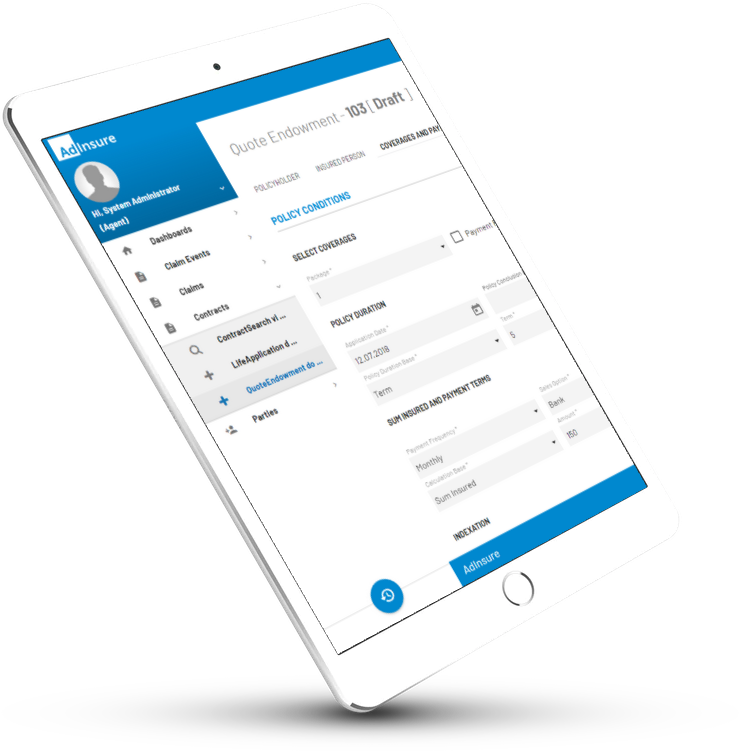

Adinsure overview

Meet the platform

AdInsure is a powerful insurance platform that makes running your business easy. Designed for Life and Non-Life insurers, it gives you the functionality and capability to streamline business processes, improve user experience and manage change effectively.

Built around industry best practices, AdInsure combines comprehensive features in a single, unified platform. It delivers an innovative environment that connects your organisation with emerging technologies, service providers, partners, and clients.

Empowering new strategies

What can AdInsure help with?

Built by a team with decades of industry experience, AdInsure supports strategies for growth and innovation.

Legacy migration

Running your business lines on out-dated systems can slow your business down and waste IT resources. AdInsure’s modular approach lets you consolidate everything onto one platform in phases, while integrating with your existing systems.

Launch new product lines

Running AdInsure in the cloud and using our predefined product library can be the fastest way to launch a new product line. We also support hybrid cloud deployment, connecting AdInsure to your existing on-premise systems.

Insurer as a platform

Digitalisation means your role as an insurer is changing. AdInsure lets you provide APIs for all products and functionalities, so you can integrate new ecosystem partners and channels, and embrace emerging insurtech.

Ideal for startups

Creating a digital insurer from scratch? Use AdInsure’s predefined processes to jump-start your operations. You can also tune the platform to your company’s needs and offer emerging products and insurance services on top of it.

Embrace the future of insurance

AdInsure is the digital foundation your business needs to keep up with industry changes. It connects and supports all of your teams, helping you work smarter, launch faster, and provide modern customer experiences.

Why AdInsure

Making life easier for both business and IT users

The platform’s business functionality makes every business user’s job easier by streamlining and automating their workflows.

And when it comes to implementing new processes or operational strategies, AdInsure’s technical capabilities give your I T team the flexibility to make it happen.

Lines of business

Extensive personal and commercial insurance coverage

AdInsure offers a comprehensive set of functionalities for both, life and non-life insurance providers, including personal and commercial lines of insurance.

Life

- Endowment

- Credit Protection

- Term insurance

- Group risk life

- Whole life insurance

- Universal life

- Unit linked

Non-Life

- Motor

- Household

- Travel

- Accident

- Property

- Liability

- Commercial motor

- Commercial property

- Commercial casualty

- Construction

- Agricultural insurance

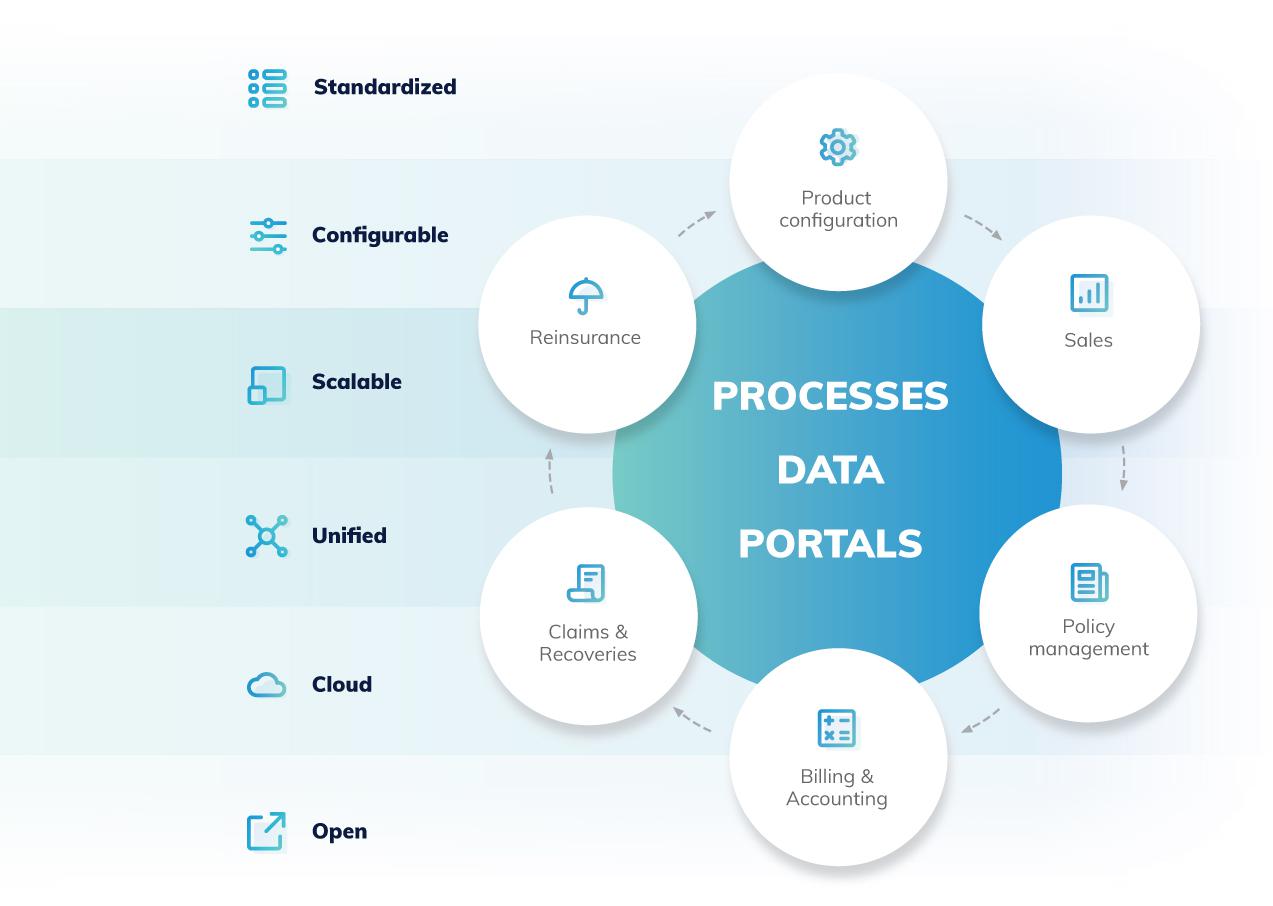

Business Functionality

Total support for all your departments

The comprehensive functionalities of AdInsure support all your teams, from product management, sales and underwriting to claims and back-office. Manage important processes, get data insights about the metrics that matter, and create custom portals for your team members.

Define and configure products

Your actuarial, product development and underwriting teams can define any product for any kind of business line you want to offer, now and in the future.

Manage every important process

Nine separate yet integrated modules help you manage every stage of the product life cycle, from policy administration to claims management.

Get data insights on demand

The powerful data dashboard gives you a 360-degree view of your customer. Get easy access to further insights by integrating an optional third-party solution.

Give every employee the right tools

Predefined user interfaces for every role means your team members always have access to the tools and features they need.

Platform Capabilities

A platform that helps you stay agile

Your business needs to keep adapting to change, and that means your insurance platform should too. That’s why we’ve built a truly open platform that can easily integrate emerging tech. And with its flexible configuration options and ability to scale in the cloud, AdInsure is a future-proof investment that will help you to stay agile.

Standardised

Adinsure is built around industry best practices to support your processes from day one, with predefined processes that work out-of-the-box.

Configurable

The platform’s functionality can be easily configured to match your organisation’s existing processes, without touching the source code.

Open

Use Rest API and OpenAPI to integrate AdInsure with external systems and portals, without the need for additional coding.

Cloud-ready

Simplify your IT requirements by running AdInsure in your private cloud, or in the public cloud with Microsoft Azure.

Scalable

Adinsure can be deployed on-premise or in the cloud, and scales up as you grow without a drop in performance.

Unified across devices

AdInsure provides a unified experience on mobiles, tablets and computers, so your team can keep working from any location.

Empowering insurance organisations to reach their potential

We are on a mission to empower change-ready insurers to reach their potential through technology from the core up

and reshape the future of insurance.

30+ years of experience

20+ successful

implementations in

9 different countries

350+ dedicated experts

International teams

based in 5 different

offices across Europe

Industry approved

Adacta is featured

in Gartner Magic Quadrant

for Non-Life Insurers, Europe

Adacta

Hi, we’re Adacta — a leading software provider for the insurance industry. Our insurance platform, AdInsure, gives Life and P&C insurers a future-proof way to streamline their operations and processes.

So, what’s special about us? Formed in 1989, we’ve spent decades helping insurance organisations to grow their digital capabilities and drive new profits. Our mission is simple: empower tomorrow’s industry leaders to reach their potential through technology.

Our culture

Going further together

Everybody has unique potential. And while our clients are the backbone of our business, we want to see our colleagues go far too. Adacta’s company culture is built on mutual empowerment – an environment where everybody has opportunities, support, and encouragement.

При подготовке материала использовались источники:

https://www.adacta-fintech.com/

https://www.adacta-fintech.com/platform

https://www.adacta-fintech.com/about-us

Онлайн Радио 24

Онлайн Радио 24